LTP Enhances Institutional Trading with Secure Liquidity Solutions and Quantitative Fund Strategies

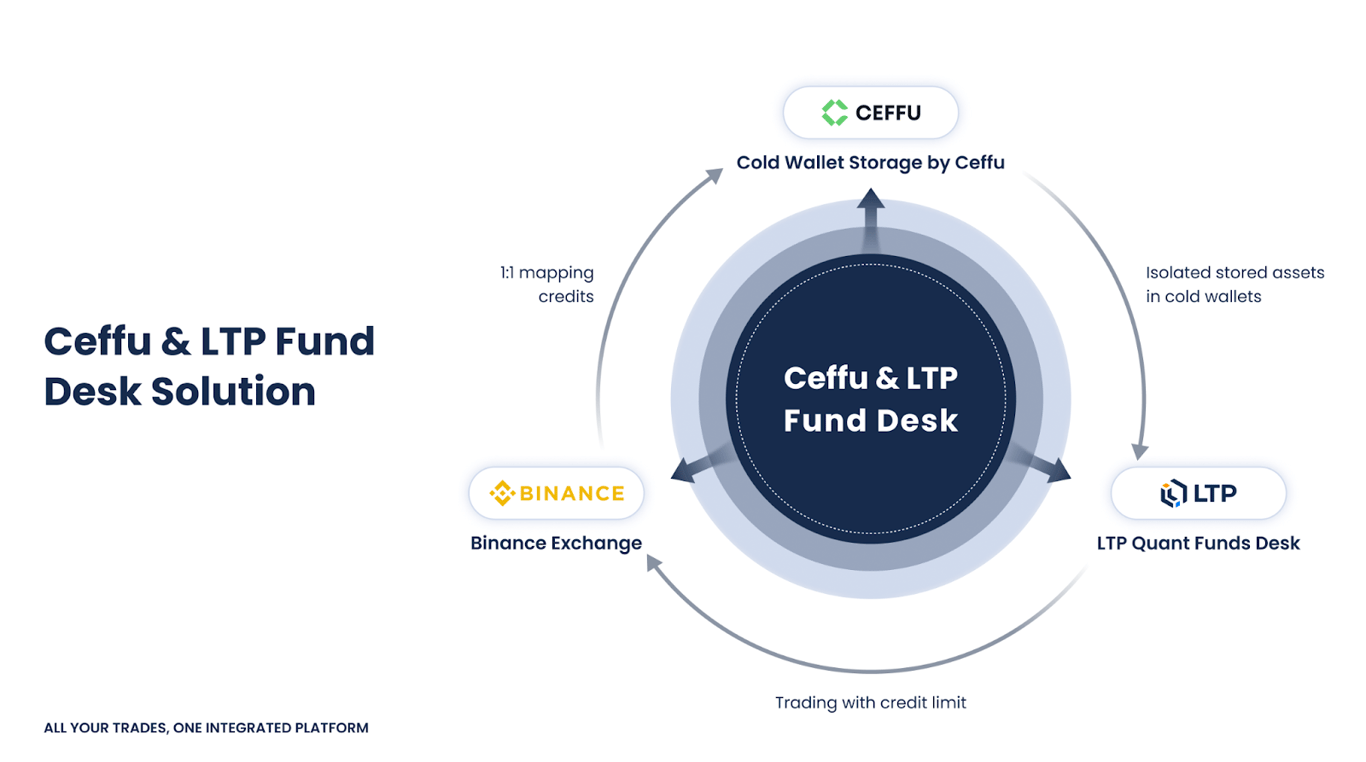

When leading digital asset prime broker LTP set out to build their Selected Fund Desk solution, they needed secure and safe access to a liquid exchange in order to effectively execute on their trade strategies. They engaged with Ceffu to deliver this infrastructure and integrated with MirrorX, our off-exchange settlement solution.

As a result, their desk has a direct connection to Binance, the world's largest and most liquid cryptocurrency exchange. All of LTP's assets entrusted to Binance are securely held off-exchange in Ceffu's custody, effectively eliminating counterparty risks. This arrangement is vital for ensuring LTP's stringent compliance and security standards are met.

By leveraging our combined expertise, LTP has developed a suite of quantitative fund products tailored for institutional investors and high-net-worth individuals, offering innovative, transparent, and secure investment opportunities in the digital assets space.

Instantaneous access to the industry’s deepest liquidity

Upon mirroring, LTP gains access to the features of the Binance Exchange, including derivatives trading on the industry's most liquid orderbook. MirrorX ensures off-chain settlements at T+1, guaranteeing prompt reconciliation of all LTP’s positions. This robust process is particularly crucial for LTP, who optimize yield through delta-neutral arbitrage.

Powering a Suite of Quantitative Trading Products

The LTP Selected Funds Desk is an asset management product that collaborates exclusively with teams renowned for their exceptional performance, robust risk control capabilities, and conservative asset allocation. Built on a foundation of carefully crafted delta-neutral trading strategies, the LTP Selected Funds Desk provides investors with exposure to the yield potential of the digital asset market.

Cash-and-carry Arbitrage

Futures contract prices tend to converge with the spot price as the expiration date approaches. When there is an unusual price discrepancy between the futures and spot prices of the same cryptocurrency, LTP leverages this by buying low and selling high. By closing the position as the price differential narrows, LTP generates profits without taking on directional risk.

Funding Rate Arbitrage

This strategy involves taking equal and opposite positions in spot and perpetual contracts. LTP collects profits from the funding rate payments in perpetual contract trades, effectively offsetting profits and losses.

Statistical Arbitrage

Statistical arbitrage relies on extensive analysis of historical data for a set of fundamentally correlated prices. By studying the stability of these relationships over time and estimating probability distributions, LTP can use fundamental data analysis to guide our arbitrage trading decisions.

Explore the exclusive range of quantitative trading strategies utilized by LTP. Visit the Selected Funds Desk page to learn more.

Institutional-grade security

During the development of LTP’s Selected Funds Desk solution, they stressed the importance of achieving operational excellence while also ensuring a secure environment where the safety of their investors’ digital assets is never a concern. MirrorX, along with its integrated Prime Wallet, instilled confidence in LTP’s development through several key factors.

Multi-party computation (MPC) technology

MirrorX is powered by our Prime Wallet solution, an MPC-powered warm wallet that ensures rapid transaction speeds while maintaining the highest level of security. Through Prime Wallet, LTP’s key shares are stored on air-gapped FIPS 140-2 devices and distributed across various geographical locations, eliminating any single point of failure.

LTP assets stay securely within Ceffu's custody

With MirrorX, assets deposited in Ceffu for delegation or undelegation to or from the Binance Exchange remain under Ceffu's custody at all times. These assets are mirrored 1:1 from LTP’s Ceffu wallet to their designated Binance subaccount, effectively minimizing counterparty exposure.

“Ceffu is known for its top-tier security, comprehensive asset management, and strict regulatory compliance. This collaboration is built on a shared vision: providing investors with the highest levels of security, transparency, and efficiency, ensuring your investments are in safe hands.” – Jack Yang, Founder & CEO, LTP

About LTP

LTP is a global institutional prime brokerage firm powering the future of virtual asset markets. LTP bridges traditional finance and blockchain innovation by delivering customer protected, regulated, secure, and scalable solutions to proprietary trading firms, hedge funds, asset managers, and financial institutions. LTP actively collaborates with regulators, industry partners, and academics to advance the global virtual asset economy.

For more information, please visit:

Learn more: LTP Official Website

LinkedIn: LTP

Twitter: @LTP_primebroker

Business inquiry: bd@liquiditytech.com

About Ceffu

Ceffu is a compliant, institutional-grade custody platform offering custody and liquidity solutions that are ISO 27001 & 27701 certified and SOC 2 Type 1 & Type 2 attested. Its multi-party computation (MPC) technology, combined with a customizable multi-approval scheme, provides bespoke solutions allowing institutional clients to safely store and manage their digital assets.

Institutions may also benefit from Ceffu’s secure gateway to a wide range of liquidity products within the Binance ecosystem. This can be achieved through MirrorX, our off-exchange settlement solution, provided in partnership with Binance.

Media contact: pr@ceffu.com

LinkedIn: Ceffu

Twitter: @CeffuGlobal